CAPITAL STRATEGY

AND

ASSET MANAGEMENT PLAN

2002 - 2005

The Isle of Wight is an island covering

38,014 hectares situated approximately three miles off the southern coast of

England. The Isle of Wight Council is

the Island’s largest single employer and manages an asset portfolio, which has

a current valuation of £197.2 million as at 31 March 2001. This portfolio includes a wide range of

assets including schools, leisure sites, corporate and neighbourhood offices,

highways and coastal defences.

At 31 March 2001 the asset portfolio

included :

|

|

|

|

%

|

|

Land and Buildings

|

160.8

|

|

81.5

|

|

Infrastructure

|

28.3

|

|

14.4

|

|

Vehicles and Plant

|

6.5

|

|

3.3

|

|

Community Assets

|

1.6

|

|

.8

|

|

|

197.2

|

|

100

|

The Isle of Wight Council’s Asset portfolio

provides legitimate right to the following resources.

Operational Building Assets

|

328

|

Buildings worth £153,000,000 including

|

|

69

|

Schools providing education to 19,393

children.

|

|

6

|

Other Education establishments

|

|

21

|

Social Services establishments caring for

the vulnerable

|

|

11

|

Youth and Community Centres with 8,839

members.

|

|

11

|

Libraries issuing 1.3m items per annum.

|

|

0

|

Housing Stock directly managed.

|

|

10

|

Fire Stations responding to 2,574

incidents per annum.

|

|

5

|

Leisure establishments including pools,

halls and theatres.

|

|

7

|

Tourist Information Centres informing 2.5m

visitors.

|

|

3

|

Waste and disposal energy centres

processing 26,728 tonnes annually.

|

|

1

|

Crematorium and 24 cemeteries managing

1,500 bereavements per annum.

|

|

4

|

Museums for 46,000 visitors.

|

|

1

|

Magistrates Court for 1,027 Court

sessions.

|

|

88

|

Public Conveniences.

|

|

17,300

|

Square metres of offices accommodating 870

work stations.

|

|

12

|

Stores.

|

The total backlog of repairs is £18.5m

Non-Operational Assets

|

|

Land and Building Assets worth £7,800,000

|

Results of National Performance Measures

A

summary of the Authority’s assets measured against national property

performance indicators is set out in Appendices 1-8 of the Asset

Management Plan.

With

a population of around 128,000, the Isle of Wight has a significant level of

disadvantage. Although part of the

prosperous South East, the Island is physically and economically separated from

the mainland. It has the lowest gross

domestic (GDP) per head in the South East region and, at County level, the

Island ranks 6th lowest in the UK.

Some of the major factors which influence the strategic planning process

on the Island are listed below:

·

Lowest average male earnings in the UK (only 3% of

Island residents are high rate tax payers – the lowest in the UK).

·

Reliance on seasonal and part-time work in tourism

services with lengthy spells of unemployment.

·

Unemployment is concentrated in the younger age group

of 19-24 year olds.

·

The Island has a higher than average proportion of

young single parents.

·

A high proportion of retired people with relatively low

incomes.

·

The percentage of the population from ethnic minorities

is well below the national average.

·

Four of the 33 electoral wards on the Island are among

the most deprived 10% of wards nationally (source: the Jarman index).

·

In rural areas it is often impossible to reach

education and training via public transport and it may be too expensive for the

unemployed.

·

Homelessness levels are high and are comparable with

cities like Coventry and Sunderland.

·

Ferry crossings are amongst the most expensive in the

UK, which serves to increase geographical isolation and consequently has a

negative impact on the socio-economic development of the Island.

CAPITAL STRATEGY

2002 – 2005

CAPITAL STRATEGY

The Council's capital investment requirements

are set having regard to the Council's corporate objectives, as reflected in

its Community Strategy and its Corporate Plan.

The Council's principal areas of capital investment relate to the

following service areas:

·

Housing.

·

Education

& Community Development.

·

Social

Services.

·

Highways

and Transportation.

·

Tourism,

Leisure Services and Economic Development.

·

Environmental

Services.

Over 80% of asset value is

contained in land and buildings, and substantial investment is required in

these sites. The Isle of Wight's

population expanded significantly in Victorian times and many of its public buildings

are old in nature and in need of investment.

Operational sites such as leisure centres, which are well used by locals

and tourists, also require ongoing investment to maintain their operational

capabilities and revenue earning capacity.

In addition the Island has coastal defences of 38.5 kilometres and

further substantial investment is needed in order to maintain these and extend

coastal defences to other areas of the coastline.

Having regard to its significant capital

investment requirements the Council has developed a three year capital strategy

which includes the following objectives:

·

The

Council’s capital strategy will seek to maximise the availability of sources of

capital finance available to it. This

will include Capital Allocations from Central Government, the generation of

capital receipts and all other relevant sources including competitive bidding

opportunities, Single Regeneration Budget (SRB) programmes, European funding,

and the National Lottery.

·

To

ensure that available resources are deployed in the most economical, efficient

and effective manner.

·

To

fully utilise the potential of partnerships to create an effective and

co-ordinated delivery of public services.

The geographical nature of the Isle of Wight means that it has no land

boundaries with other local authorities and joint working with other local

agencies is a prerequisite for effective and efficient service delivery.

2 Corporate

Objectives

The Council's current

objectives are:

·

To

care for vulnerable and disadvantaged people.

·

To

raise standards of achievement, encourage learning and promote opportunities

for all.

·

To

develop the knowledge and skills needed for employment opportunities.

·

To

protect and enhance the health, safety and environment of the Island and its

people.

·

To

develop the Island's transport network for the benefit of local people.

·

To

support and develop Council staff and to manage the Council's property and

other resources efficiently and effectively.

·

To

promote sustainable tourism, leisure, cultural and economic development.

The Council's corporate

objectives were reviewed in the 2000/01 financial year and approved by the

Council in April 2001. These objectives

are contained in the Council's Corporate Plan, and Appendix A illustrates the

Council’s Hierarchy of Plans.

The Council works with a wide variety of

organisations including other Council's, the voluntary sector, public sector

agencies and the business community.

The Council has developed a

wide-ranging basis of consultation across all service areas and these include:

·

the

formation of community fora to introduce greater public involvement in Council

decision making and the setting of strategies and plans.

·

a

Citizens Panel has been established involving 2500 people who are

representative of the Island population and are consulted on Council services

on a regular basis. The Panel were

consulted on five occasions during the 2001/02

financial year.

·

the

use of Mori Polls across the Island.

·

Public

Consultation throughout the Island on the Council’s Budget Strategy.

Consultation is also taken

with stakeholders in specific service areas and these include:

·

consultation

on Housing as detailed in the Council’s Housing Strategy. This involves regular consultation with

local Registered Social Landlords (RSL).

The Council is an LSVT Authority and committed to the provision of

housing through the RSL movement.

·

the

Education capital programme is evolved through consultation with a forum

involving all Head Teachers, School Governors and representatives of the

Diocese, and is linked to the Asset Management Plan for schools.

·

extensive

consultation exercises are carried out for the Unitary Development Plan, Local

Transport Plan, and for large capital schemes.

A current major consultation concerns the potential pedestrianisation of

the centre of Newport, the Island’s capital town.

·

following

the outcome of its Best Value Review for Leisure Services, involving extensive

public consultation, the Council has agreed to outsource its Leisure Services

to a Leisure Trust. This decision has

been assessed as the best way forward for the generation of capital investment

in Leisure Facilities for the Isle of Wight.

The outcome of all

consultation exercises are received by the Capital Strategy Group for

consideration in the prioritisation of capital investment, and the potential

for cross-cutting service initiatives.

The Council will make

available to its stakeholders and partners, the outcomes of all consultation

initiatives and its response to them.

1. In

determining its capital strategy the Isle of Wight Council seeks to maximise

the value of its capital spending with the capital expenditure of other key

organisations on the Island. To achieve

maximum value from capital resources the Council works to generate an optimum level

of capital investment from external resources and from joint working with

partnership organisations on the Island.

Co-ordination with the Council's partners in social and economic

regeneration is crucial to identifying strategic priorities and managing their

implementation.

As a

relatively small Unitary Authority, the Council recognises the importance of

Partnership working in a small community, which faces additional costs relating

to its severance by sea. The Council

has a long-standing commitment to Partnership working and examples of

partnership delivery and the outcomes achieved include:

·

Waste Management: following the first PFI

project of its type, the Council entered a long-term contract with an annual

value of £5 million. This has provided

an excellent service and achieved one of the highest ratings in the country for

the recycling of household waste and composting.

·

Isle of Wight Economic Partnership (IWEP): the Partnership was

established as a Company in 1999, and has responsibility for economic

development and regeneration. The

Partnership also has responsibility for managing the Council’s four successful

Single Regeneration Budget (SRB) programmes.

Since its establishment the IWEP has created or safeguarded over 1200

jobs, and delivered SRB projects valued at £20 million and benefiting over 1500

voluntary groups.

·

Early Years Childcare Development Partnership: this Partnership was

established in 1997 to oversee the development of early years provision on the

Island. It is independently chaired and

exceeded the Government’s targets for 3 and 4 year old places. This innovative Partnership involves 43

independent pre school providers in 46 primary schools, and has topped relevant

inspection performance tables.

·

Crime and Disorder Partnership: jointly chaired by the Council and the Police

Authority, the partnership has achieved a significant reduction in crime (down

13% in 2001/02). It has also achieved

significant investment in CCTV through partnership funding with local community

forums and Parish and Town Councils.

·

Tourism Partnership: the Tourism Partnership brings together the Council

and a wide range of tourist industry representatives to market the Island as a

tourist destination. Its successes is

demonstrated by continued industry support, both financial and operational.

The

Council continues to be successful in partnership working with other local and

national organisations and Appendix B details some of the projects which have

been recently undertaken or that are currently in progress. The Council is also

exploring the benefits of alternative methods of capital expenditure

procurement, and a recent Partnership contract has been secured to develop the

Harbour Project at Ventnor.

The Council's corporate strategy for capital

investment embodies individual strategies for the following service areas:

1.

Education

The Education capital

strategy encompasses the provision of basic need school places in accordance

with DfES guidelines (sufficiency). It

is heavily influenced by the Asset Management Plan for Schools having regard to

identifying areas of future needs, school condition and suitability. The strategy encourages joint working (under

specific DfES initiatives) with schools and other relevant outside bodies eg

healthcare, early years agencies, social services, the IW Economic Partnership,

the Diocese, the ESF, police, etc.

2.

Housing

The Housing Investment

Programme (HIP) includes the Council providing resources for capital investment

to registered social landlords, for both new build property and property

purchase. This investment is financed

through its annual housing capital allocation, together with additional

investment from the Council's generation of capital receipts. Homelessness is a major problem on the Isle

of Wight and affordable rented accommodation in areas providing employment is a

major priority. The Isle of Wight

Council will also provide for maximising capital resources in respect of its

private sector housing renovation grant programme and the provision of Disabled

Facility Grants.

3.

Social Services

The Isle of Wight Council serves an

increasingly elderly population, and capital investment on facilities enabling

people to remain in their own homes is a current priority. The Council

encourages and enables continued independence of the individual and so help

contain the demand for permanent residential provision. With respect to Children's Services the

Council will assist vulnerable families to access a range of high quality

services promoting their well being and quality of life.

The Council is also

currently engaged in a major partnership initiative with the local Health

Authority, under the provisions of the Health Act 1999, and has successfully

obtained Supplementary Credit Approval (SCA) for capital investment to

facilitate this joint working arrangement.

4.

Highways and Transportation

The Council has approved a

five year Local Transport Plan (LTP) for the period 2001/06. The plan builds on objectives to reduce the

need to travel, increase transport choice and travel by sustainable means. The document takes account of local issues

concerning social exclusion, health, education and economic developments and is

linked to the Community Strategy and Corporate Plan.

5.

Economic Development

The Isle of Wight Council is

currently the accountable body for four Single Regeneration Budget (SRB)

programmes. These programmes relate to

training and employment of the Island’s workforce and the successful economic

regeneration of its principal towns.

SRB programmes are managed through the Isle of Wight Partnership, and

capital investment is designed to attract significant matching funding from

Partner organisations and the private sector.

6.

Emergency Works

In addition to the above

determined investment priorities the Council has substantial demands placed on

its capital resources arising from coastal erosion, land movement and

associated works arising from prolonged periods of heavy rainfall. The Council has recently compiled a grant claim

to the Government in accordance with the Bellwin Scheme, and further evidence

has been produced to Government Office to substantiate further financial

assistance. Since November 2000 substantial land movement has led to the

need for works at an estimated total cost of £7 million. This figure includes approximately £4.5 million to reinstate a

principal road serving the South of the Island and a large number of small

communities, and forming an important part of the Tourism and Economic

infrastructure. Given the substantial

effect this could have on Capital resources contact with Government Office is

fundamental to overcome the potential financial difficulty posed by these

works.

The Council has adopted an

Executive and Select Committee style structure in accordance with the

Government's Modernising Agenda.

Capital Investment decisions are made by the Executive in order to

embrace a cross cutting service approach and a corporate strategy for future

capital investment.

The Council has set up six Select Committees

covering each of its principal service areas.

These Committees will have a scrutiny role in examining value for money

in service areas, and also to question the decisions taken by the

Executive. Each Committee will also

provide advice to the Executive on their respective areas of activity, advise

the Executive of their priorities for capital investment in projects, and have

a role in policy development. A Liaison

Committee consisting of the six Select Committee Chairman has also been

established in order to address cross cutting service issues.

In order to facilitate a corporate capital

strategy, the Council has put in place a Capital Strategy Group of officers

whose brief is to advise the Council's Directors through its Board of Strategic

Directors. This Group includes a senior

manager from each of the Council's Directorates and also the Council’s Lead

Officer for Best Value. The Group meets

on a regular basis to formulate capital programme proposals and to monitor

progress against the programme. The

Group will also consider and advise upon the capital implications arising from

the outcome of Best Value Reviews. The

Director’s Board are charged with making recommendations to the Executive on

capital investment and financing matters. Since the inception of this corporate

approach to capital investment, the Council has endorsed all capital investment

recommendations that have been made to it over a three year period.

Bids for capital resources are invited from

all service managers who recognise the need for investment in their service

areas. The bids are aggregated for each

Council Director who will decide as to which of his priorities will be put

forward to the Capital Strategy Group for consideration and

prioritisation. In order to facilitate

this each Director will complete for each project a capital project appraisal

form. The appraisal form (attached as

Appendix C) is then presented to the Capital Strategy Group where it is then

evaluated having regard to the following information:

·

Description

and location of proposal

·

A

need and justification statement

·

Alternatives

and options appraisal

·

Timetable

and capital cost, including necessary consents

·

Revenue

implications, both service and capital financing

·

Council

policies/strategic objectives/service plan met by the scheme

·

Scope

of project and consequences of not undertaking

·

Potential

partners and areas of potential financial assistance

·

Government

policies affecting project

·

Link

to Community Strategy and Corporate Plan

·

Health

and Safety and Legal requirements

The projects will then be

assimilated and presented with the recommendations of the Capital Strategy

Group to each relevant Select Committee for their consideration and

analysis. In order to assist option

appraisal a scoring mechanism has been devised and this has been approved by

the Executive as part of the Project Appraisal document.

Prioritised bids will be

forwarded to the Executive during the course of the budgetary process, and the

Executive will take decisions as to the allocation of available resources.

In addition to Government

credit approvals, capital receipts from the sale of surplus Council land and

property form a very significant part of the Council’s capital financing

resources. Surplus and potentially

surplus land and property is held on a central database and prior to the start

of each financial year the Property Services Manager and the Corporate Finance

Manager will assess the level of capital receipts which can be targeted in the

ensuing financial year.

A three year sales programme is then

formulated to ensure that the appropriate number of properties are prepared for

sale and marketed to reach the target.

All asset disposals are agreed by the Council’s Executive and then

marketed to reach the sales target.

Progress with the sales programme is

monitored on a quarterly basis by the Property Services Manager and Corporate

Finance Manager. Where there is any

slippage in the capital expenditure programme or in the production of capital

receipts, the Corporate Finance Manager will apply the necessary accounting

treatment in order to best maximise the Council's overall capital resources.

The Capital Strategy Group also have responsibility for advising Directors as

to new and additional sources of capital finance which may become available.

The Council will continue to encourage

partner organisations to reflect their involvement in the Council's capital

programme, by contributing to costs where appropriate. The Council will consider all methods of

procuring and financing its capital programme, including Public, Private

Partnerships (PPP) and the Private Finance Initiative (PFI) if they can be

demonstrated to represent Best Value. A

successful PFI project in respect of Waste Collection and Disposal is

financially supported by Government and the Council will also continue to

enhance capital investment through the use of Planning agreements. The Capital Strategy Group also have the

responsibility of advising on the availability of all internal and external

sources of capital finance to stakeholders and partners.

The Council has set aside resources that can

be accessed by local community organisations who have raised matching sums to

progress local community led capital investment. This approach helps promote cross-cutting initiatives,

partnership working and enhances the resources available for investment.

The Council will continue to use Operating

Leases to supplement capital investment, where it is economically prudent to do

so. The acquisition of assets via

operating leases will be co-ordinated centrally by the Director of Finance and

Information, which will:

·

Ensure

that the Council does not enter any lease agreements which are not operating

leases, and would therefore qualify as credit arrangements and incur capital

expenditure consequences.

·

Provide

a corporate framework for the management and control of leased assets.

·

Achieve

economies of scale through the procurement process.

The Revenue costs of all capital schemes, both

service related and capital financing will be identified consideration in for

the formulation of the Council’s capital programme and revenue budget, this

information must be identified on each capital project appraisal form.

The capital strategy will be

the subject of a continuous review having regard to outcomes from Best Value

reviews, and any changes in government legislation in relation to capital

control mechanisms and the introduction of the new “Prudential” control

framework, planned for the 2004/05 financial year.

The Council has introduced a three-year

capital programme, which will be considered each year as part of its budget

cycle, with effect from the 2002/03 financial year. Having regard to the demand for capital resources, careful

planning is crucial in order that they can be maximised.

Capital expenditure monitoring reports are

produced for all capital projects on a monthly basis. These reports are

distributed to all Directors who have responsibility for capital projects, and

to Members of the Council Select Committee for each respective service

area. The newly created member led

Measuring Performance Task Group will oversee the performance of capital

projects.

Directors responsible for capital schemes

will continue to work with the Capital Strategy Group to maximise the benefit

of all services from capital investment.

This relationship is a key component of the project appraisal process

and also ensures that solutions that cut across boundaries are recognised at an

early stage.

A substantial amount of capital resources are

invested in the Council’s Asset Base, and part of the Asset Management process

provides for a comprehensive annual assessment of all capital building

projects. This report is submitted to

all Directors, the Council Executive and Resources Select Committee.

The Council has subscribed to the CIPFA

Benchmarking Club and will be reporting on all benchmarked activities on a

regular basis to each Select Committee.

Membership of the Treasury Management Benchmarking Group has been

effected to monitor the cost of Capital Financing, and the Council’s

performance in this area is reported to the Council on an annual basis. The Council has also arranged for a Peer

Group Review to take place through the Improvement and Development Agency

(IdeA) in June 2003. It is intended to

use this review to benchmark the Council using the methodology contained in the

IdeA report “Benchmark of the Ideal Local Authority”.

With regard to investment in Housing, project

evaluation on RSL investment is undertaken by the Housing Corporation. The Council reports on the completion of

housing schemes through its Social Services and Housing Select Committee.

Each capital project will be subject to a

post project evaluation and details of the Council’s Performance Review

activity are contained at Appendix D.

Any further information on the Capital

Investment Strategy can be obtained from the following nominated Officer for this

purpose:

Contact: Mr

Gareth Hughes, Corporate Finance Manager (Tel No 01983 823604) (e-mail address:

[email protected])

APPENDIX A

Hierarchy of Plans

Working

with its partners the Isle of Wight Council has established the Island Futures

Partnership.

The

overall vision for the Council is set out in the Island Futures Community

Strategy. This document, prepared from

extensive consultation with the community outlines the community’s priorities

and objectives. To deliver Community

Strategy the Council has prepared a framework of integrated documents, shown

below, that provide the vehicle for turning this vision into reality. This Capital Strategy is a key document in

this framework and plays a fundamental role in ensuring that the resources of

the Council are targeted towards delivering the Community Strategy.

The

results of the consultation exercise have been a key input to the Council’s

Corporate Plan, which makes explicit the Council’s contribution to the delivery

of the Community Strategy.

These

plans are reviewed and updated annually in the light of changing priorities and

resources, ongoing consultations, as well as the outcomes of the Best Value

reviews etc. to ensure that they reflect current community needs and are

achievable.

APPENDIX B

|

HOUSING

|

|

Project

|

Partners

|

Community Links

|

|

Foyer Project at Ryde,

Isle of Wight

|

Medina Housing Association

Ryde Community Forum

Isle of Wight

Partnership

|

Smallbrook Sports Centre

Isle of Wight College

|

|

Project Outline

This

project is designed to provide accommodation, personal and skills training,

and employment opportunities for young people. This project is being delivered through the Isle of Wight

Partnership and a successful Single Regeneration Budget Programme. The project is complete, occupied to its full capacity,

and consideration is currently being given to a similar scheme elsewhere on

the Island.

|

|

SOCIAL

SERVICES

|

|

Project

|

Partners

|

Community Links

|

|

Respite Care Home for Children with Multi

Disabilities

|

Isle of Wight Health Authority

Isle of Wight Healthcare Trust

Private Sector Partner

|

Families

Support agencies and

groups

|

|

Project Outline

The project makes

innovative use of combined land and property resources across three public

service organisation, to provide a home offering temporary and permanent

accommodation for children with multi disabilities. There is currently no such permanent accommodation on the Isle

of Wight. Planning permission

has been obtained for the development and invitations to private investors

have been made..

|

|

HIGHWAYS

& TRANSPORT

|

|

Project

|

Partners

|

Community Links

|

|

Cycleways

|

English Partnership

SUSTRANS

Isle of Wight Tourism Partnership

Southern Water

Private Land Owners

|

LA Agenda 21

Local Transport Plan

Access to Countryside

Health Programme

|

|

Project Outline

The project aims to

create a network of off road cycleways radiating out from the Island’s centre

to all towns and villages using principally former railway tracks now

upgraded. A link from Wootton to Newport the Islands

capital town has now been opened, and a Newport to Sandown link is planned to

be open later this year.

|

|

ENVIRONMENTAL

|

|

Project

|

Partners

|

Community Links

|

|

Island 2000

|

Millennium Commission

Suffolk Developments (Private Sector)

Sandown Town Council

Southern Water Ltd

Biffa Waste Management

Ltd

|

Friends of Ventnor Botanic Gardens

Sandown Business Association

Ventnor Regeneration Forum

|

|

Project Outline

This millennium project

includes the development of a visitor centre at the Ventnor Botanic Gardens

and a Dinosaur attraction at Sandown.

These involve capital expenditure of

£4.3 million in providing Leisure & Tourism attractions at the

relevant sites.

The Ventnor project was opened by Botanist David Bellamy on 20 April

2000, and the Sandown project is was opened in August 2001. The Business Plans for both projects have

been successfully implemented..

|

|

EDUCATION & COMMUNITY

|

|

Project

|

Partners

|

Community Links

|

|

West Wight Community Centre

|

Totland Parish Council

National Lottery

Freshwater Parish Council

Isle of Wight Health Authority

West Wight Swimming Pool Trust

West Wight Middle

School

|

Social Inclusion

Formation of a new West Wight Community Trust

|

|

Project Outline

The project provides

for a community centre (retaining existing swimming pools), Youth &

Community Centre and Sports Hall in a remote community of The Isle of

Wight. The project involves capital

investment of £2.9 million, and has been successfully completed. The new community centre was officially

opened by the Chairman of Totland Parish Council on 29 July 2000, and is now

fully operational.

|

|

COASTAL PROTECTION AND

ENVIRONMENT

|

|

Project

|

Partners

|

Community Links

|

|

Ventnor Harbour

|

Local fishing community,

Government (DEFRA) Government Office (GOSE)

re. SRB Funding

|

Job creation

Enhanced Tourism

Environment

Ventnor Regeneration Forum

|

|

Project Outline

|

APPENDIX

C

ISLE OF WIGHT COUNCIL

CAPITAL

PROJECTS APPRAISAL FORM

Project Title ______________________________________________

Initiating Directorate ___________________________ Completed by _________________

Project Reference _____________________________ Tel. No.

_____________________

Notes on the completion of this form are attached

1. Brief description and location of proposal

2. Need

and justification for proposal

3. Alternatives

and Options

4. Timetable

and Capital Cost

Attach

a timetable and financial statement for each alternative or option. (Form CA1 attached)

Number

of financial statements attached

_______________________

5. Site

ALREADY OWNED / TO BE ACQUIRED

(Delete as necessary)

PLANNING APPROVAL REQUIRED

(Delete as necessary) YES

/ NO

6. Other authorities,

departments or bodies involved

7. Council policies / strategic

objectives met by the scheme

8. Scope of Project

9. Consequences of not

undertaking project

10. Grants and assistance available

towards project

11. Government policies affecting

project

12. Revenue implications e.g. personnel, vehicles, equipment and

associated revenue expenditure / income.

13. Priority Ranking

This

project is ranked _______ out of a total of _______ projects submitted from my

directorate.

14. Other Comments

Signature

of Chief Officer ___________________________________________________

Completed

forms should be returned to the Director of Finance and Information

The

Project Evaluation Score Sheet overleaf should be left blank, to be completed

by the Capital Strategy Group.

Project Evaluation Score Sheet

To be completed by the Capital Strategy Group

|

1.

|

A

need and justification statement.

|

|

|

|

2.

|

Legal

Requirements

|

|

|

|

3.

|

Health

& Safety Requirements

|

|

|

|

4.

|

Revenue

Costs or Income Implications

|

|

|

|

5.

|

Council

Policy / Strategic Objectives met by the Project

|

|

|

|

6.

|

Link

to Community Strategy and Corporate Plan

|

|

|

|

7.

|

Generation

of External Funding from Government or Partnership Arrangements

|

|

|

|

8.

|

Availability

of Capital Resources

|

|

|

|

9.

|

Budget

costed with full option appraisal

|

|

|

|

10.

|

Special

Circumstances / Compliance with Best Value Review

|

|

|

|

|

Total Score for Project

|

|

100

|

All

elements are scored on a 1 to 10 basis to make up a final score.

Signed

………………………………………….. Dated………………….

Signed…………………………………………... Dated………………….

APPENDIX D

PERFORMANCE

REVIEW

REVIEW OF CAPITAL PROJECTS

Following completion of each

capital project the Project Lead Officer and project team will review performance. The amount of time spent on the review

should reflect the size and complexity of the piece of work. For example, a small piece of building

maintenance work may simply take the Lead Officer minutes to review,

particularly if everything went according to plan. However, a larger scheme may involve the project team in a

detailed review session.

The review should be carried

out in a constructive way with the objective of identifying lessons for the

future. It will look at the pre-build

stages e.g. feasibility, as well as what happened on site. The Lead Officer will be responsible for

initiating the review and ensuring that any outcomes or conclusions are

communicated to the appropriate people.

The review will include the

following aspects::

·

reviewing

professional support used – were the right people involved, at the right time,

in the right way?

·

reviewing

Consultants/Contractors performance – is there anything to follow up?

·

were

the project objectives met?

·

did

the project run to timetable?

·

did

it run to budget?

·

has

it provided value for money?

·

did

the project team work well together?

·

what

is the feedback from end users?

·

what

went particularly well?

·

what

did not go so well?

·

what

have we learnt for the future?

·

who

do we need to communicate the lessons learnt to?

The

Audit Commission Report “Just Capital” identified best practice in the

management of capital projects and its content provides the principal guidance

to be followed by the Council in its project evaluation process.

PERFORMANCE

MEASUREMENT ACTIVITY

- The Council is active in benchmarking the cost of capital

financing through the CIPFA Treasury Management benchmarking club. This activity helps support the

Council’s corporate objective of efficient and effective use of resources

and performance is reported annually to the Council.

- The latest CIPFA Capital Expenditure and Treasury Management

statistics, for the 2000/01 financial year, demonstrate an average

interest rate paid by the Isle of Wight Council which is 0.96% less than

the average for English Unitary Authorities. On the Council’s current

capital loan portfolio this would involve an annual saving of over

£800,000 compared with the average Council.

- Successful Management of the capital programme and capital

resources, has led to the Council utilising all capital resources that

have been allocated to it. This is

evidenced by the use of Basic Credit Approval (BCA) in CIPFA Capital

Expenditure and Treasury Management statistics.

- The Council has maximised and fully utilised resources available

to it through its SRB programmes.

All expenditure and outputs are subject to External Audit, and are

monitored by Government Office.

With regard to successful European Funding the Isle of Wight

Council has been one of the most successful of all English Authorities.

- The substantial investment in Building Projects provides for a

comprehensive annual assessment of all such projects, in particular cost

and time predictability measurement.

This report is provided to Directors, the Executive and Resources

Select Committee and forms part of the Council’s Asset Management Plan.

- The Council is examining different options for the procurement of

capital expenditure projects. A

contract arrangement has just been entered into with a specialist contract

for the delivery of the Harbour Project at Ventnor (see Appendix C for

project details).

ASSET MANAGEMENT PLAN

2002 - 2005

1 ORGANISATIONAL ARRANGEMENTS FOR

CORPORATE ASSET MANAGEMENT

The Isle of Wight Council Asset Management Plan

(AMP) provides the foundation for developing the principles of corporate

property management across all services.

The plan supports the Council’s overarching Corporate Strategy and

service plans by creating a corporate process for optimising the contribution

that property assets make to deliver quality services to the community.

We believe that this plan meets all the primary

requirements laid down by Government Office and the majority of the secondary

ones. Targets and plans are in place to

ensure that all secondary requirements are met within two years. A checklist is provided with this Asset

Management Plan.

The

Council’s overall vision outlined in the Corporate Plan is to “Improve Island

Life”. To realise this vision, seven

key goals have been agreed which will inform the AMP process. The box below indicates some of the links

between the Corporate Strategy and the AMP.

At the Council’s Executive meeting

held on 16 July 2002 Members agreed this revised AMP. The Council’s Best Value Review for Asset

Management Planning also agreed the need for a Corporate AMP in November 2001.

1.4 Achievements

·

Successfully achieved disposals targets.

·

Isle of Wight Society Conservation Awards in respect of

building works.

·

OFSTED – LEA Property Management and Property Services

“provides an excellent service” and “is an example of Best Practice”.

·

Property Services is Investor in People accredited.

1.5 Asset Management links to

Council Strategy

1.6 Community Wide Partners include:

|

>

Central Service Managers

>

Frontline Service Providers

>

Customers and Community

>

Elected Members/UNISON

>

Health, Police, Courts, Probation

>

Parish and Town Councils

>

Island Futures Partnership

> Voluntary organisations/groups

|

> Private partners and companies

> Isle of Wight Tourism Partnership

> Government Departments

> Isle of Wight Economic Partnership

> Government Office

> Regional Assembly

> Isle of Wight College

> Portsmouth Dioceses

|

1.7 Asset Management Group (AMG)

At the centre of this top down, bottom

up planning and consultation process is the Asset Management Group chaired by

the Corporate Property Officer (CPO) who was appointed by the Council in

October 2001. The AMG includes Asset

Managers from each service plus Finance and Information (ICT).

The terms of

reference for the group include:

|

·

Strategic Management of the Council’s Assets

·

Improving Asset Management

·

Establishing Best Practise

·

Co-ordinating Service AMP’s

·

Linking strategy to operations

·

Recommending change

·

Officers report on the use of assets within their

service

|

This group is linked to the Capital Strategy Group chaired by the Corporate

Finance Officer or CFO. The reporting

lines both at Officer and Member level are clear and set out in the following

diagram:

AMG meetings are arranged on a quarterly basis and

stakeholders are encouraged to challenge the use of the property they occupy

and consider increased utilisation of assets examples of this are:

|

·

Westridge Centre shared by Tourism and Wight Leisure

·

Local library co-located with Niton School by May

2003. If successful similar schemes to be developed elsewhere.

|

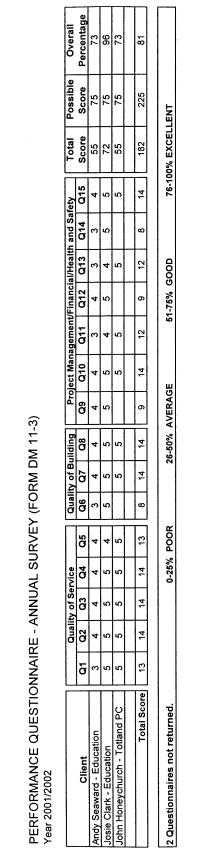

See Appendix 1 for minutes of a previous AMG

meeting.

1.8 Service Level Agreements

Service Level Agreements

are in place with each Directorate and these are now being reviewed for the

next three years. Service Departments

are given an opportunity to indicate their satisfaction with the performance of

Property Services and a stakeholder satisfaction questionnaire is in

place. This gives stakeholders an

opportunity to challenge Asset Management.

Two

other senior management groups input to asset management. They are the Project Liaison Group and Capital

Strategy Group, which monitors the capital strategy and asset changes. Both meet on a regular basis where CPO and

stakeholders have the opportunity to discuss property related matters and

opportunities for improved utilisation.

1.9 Portfolio Holder for Resources

The

Council has implemented a Cabinet style Executive which includes an Elected

Member, who is responsible for Resources including property assets. The Portfolio Holder for Resources is fully

consulted and briefed throughout the process of all changes and presents all

asset related reports to the Executive, which meets every 14 days.

1.10 Asset Management Task Group

Elected scrutiny of Asset

Management is undertaken by the Resources Select Committee. The Select

Committee has this year appointed a new Task Group formed with Elected Members

and advised by the CPO, Asset Manager and Building Manager. The Task Group makes recommendations to the

Select Committee which in turn advises the Executive. The main work of the Task Group currently includes :

·

To identify opportunities for the Council to further

optimise use of Council office accommodation and ICT.

·

To review arrangements for the disposal of surplus

property assets.

·

To review the Council's storage requirements.

The

CPO reports to the Executive Board and Directors. The CPO role is to :

|

·

Help prioritise local decisions on spending.

·

Integrate property decision-making into the corporate

planning process.

·

Ensure that property decisions are consistent with

service requirements.

·

Identify opportunities for innovation.

·

Provide a context for evaluation of capital projects.

·

Provide a basis for developing public private

partnerships.

·

Identify assets suitable for investment or disposal.

·

Identify opportunities to increase income generation

or reduce expenditure.

|

1.12Corporate Ownership of Assets

Council property is

corporately owned and stakeholders are consulted on utilisation and advised on

costs of ownership. To further develop

this understanding an Occupancy Agreement is included in Service Level

Agreements. The agreement sets out

responsibilities for both Property Services and the occupying Service.

1.13 Best Value

The

findings of the Best Value Review supported the provision of the ‘in-house’

Property Services and that the service is efficient in terms of the service and

its costs.

2 CONSULTATION

A

local protocol with Parish and Town Councils provides that the Executive shall

consult all property transactions with local Councils or local forum prior to

consideration. All major redevelopment

proposals are consulted through public exhibition and analysis of public

returns from questionnaires, all of which helps inform the decision-making

process.

Operationally,

each service area of the Council is required to produce an annual service

plan. All Service Plans are submitted

to the Head of Policy by the end of April 2002 and data extracted and

distributed to service providers, such as Property Services, by mid May

2002. Service Plans consult service

groups, providers and partners.

Corporate

Management Team Executive

Corporate

Management Team Executive

Service

Plan Resources

Select Committee

Service

Plan Resources

Select Committee

Occupiers/ Parish Councils and

Partners Local

Forums

AMG

This

is a cross-membership Senior Officer Group, led by the Design Manager, which

has been established this year with the following aims and objectives :

·

To provide a corporate co-ordinated approach to the

design of buildings, building conservation, urban design, landscape design,

civil engineering and highway design, with regard to the built environment.

·

To provide a new built environment that meets client,

stakeholder and Council objectives.

·

To provide a sustainable built environment using

appropriate materials with low life cycle

costs.

·

To promote high quality design and embrace the changing

construction industry.

·

To promote high standards of health and safety in

design and construction.

·

To raise standards in design and learn from critical

analysis of past projects.

·

To implement a strategy to give Council representatives

greater control overseeing private developers’ projects on Council land.

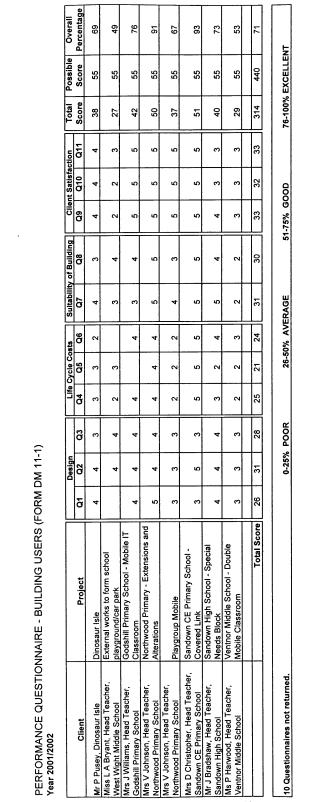

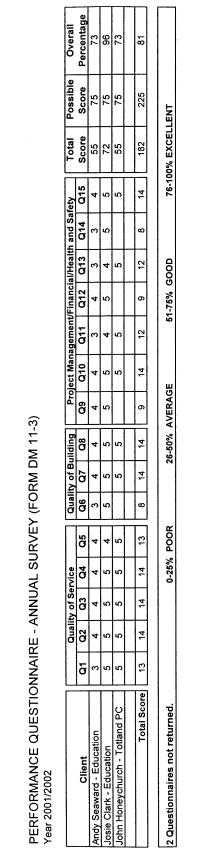

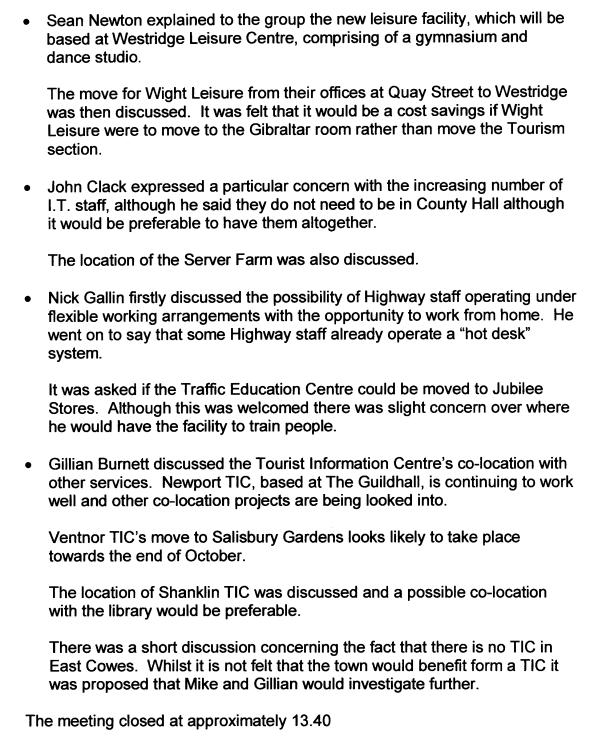

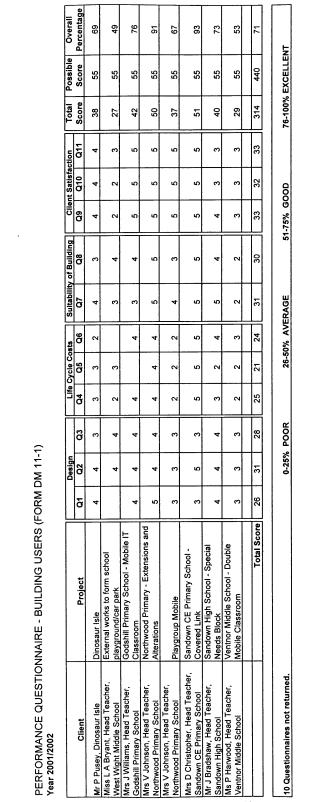

The Design Manager sends out questionnaires

at the end of March to building users after completion of capital projects to

assess the performance of Property Services and determine areas for

improvement. These are independently

assessed. See Appendix 2.

The

Council’s contractors are also assessed internally and findings are fed back to

the contractor in order to promote improved performance.

|

A

successful group who, through a good consultation process have consistently

delivered top quality projects with

high levels of satisfaction. Awards

in 2001 include a Conservation Award for Northwood Primary School.

|

2.3 Framework

for Corporate Decision Making

The

diagram below shows the framework for decision-making including the

implementation of the Asset Management Plan

Executive

Executive

Resources Select Committee

Resources Select Committee

Property/Asset Task Group

Portfolio Holder for Resources

|

Asset Management Group Asset Management Group

|

Stakeholders Consultees Senior Managers

3 DATA MANAGEMENT

(How asset data is collected, recorded, managed and used to support performance

management)

3.1 Existing Data Systems

Since its

formation as Unitary Council in 1995 the Council has progressed investment in

resources and training for new ICT. The

development of new technology tools for the Asset Management Plan has been

through a modular approach building on existing systems and buying in new

software as funding permits. The CPO

and AMG are currently examining the purchase and development of a fully

integrated ICT system. A business case

of need was prepared in January 2002

identifying where existing systems do not meet needs and a range of packages

are being examined to include in the future data about suitability and

sufficiency. See below under 3.2 for

schedule.

Property

Services maintains the following Authority-wide Data modules:

·

Central Asset Register – this is primary

property information for each asset and includes Unique Property Reference

Number (UPRN) for both land and building, name, categories, value,

etc. This module is in ACCESS and is

developed in house (see box). The UPR

acts as the link to each data module.

|

UPR

|

DESC

|

USE

|

FLOOR

|

VALUE

|

TYPE

|

|

X0733

|

Arreton

CE Primary School

|

School

|

380

|

339500

|

B

|

|

REVIEW

|

DIRECTORATE

|

CATEGORY RESULT

|

RV

|

DEED NO

|

|

1999

|

Education

|

Operational

|

24

|

61

|

|

|

|

|

|

|

|

|

·

Individual Asset Plans – these sheets bring

together intelligent primary and secondary data for each asset. Each Individual Asset Plan records

performance, condition and a stakeholder agreed statement recording future

objectives for the asset. Behind the

cover sheet are floor plans, planned maintenance and valuation.

All data is verified through internal

assessment to ensure accuracy and that it is up-to-date.

·

Condition Surveys – this module has been

purchased from IPF together with hand held data capture devices for building

condition surveys. A systematic review

based on a rolling programme of surveys is being undertaken which is virtually

complete. A programme for reviewing 20%

of assets year on year is in place.

·

Capital Disposal Data – The Register records the

primary data including value of all surplus assets pending disposal.

·

Asset Valuations – Individual property values

are calculated for land and buildings; the results are being recorded on Excel

spreadsheets, with a 20% review each year as with condition surveys.

Scanning/Computer Aided Design – the

Authority has invested in these systems using Autocad release 2002, with staff

training ongoing. All new and existing

drawings for operational assets are being computerised in support of individual

asset plans. The aim is to provide a

network of information available to all Internal Stakeholders by April 2003.

3.2 Fully Integrated Property

Information System

As a result of the Council’s first AMP

in 2001 Property Services is this year actively investigating a fully

integrated Asset Information System.

The planned start date is April 2003.

The procurement process is well advanced. The package will provide for the integrated organisation and

utilisation of existing and new data in order to assess the performance of

assets and make informed property related decisions. The working timetable is as follows :

End April 2002 - Presentations by potential suppliers

and site visits

End May 2002 - Internal consultation including AMG,

Education, Finance and ICT

End June 2002 - Produce specification for system

End June 2002 - Tender documents to be issued

End August 2002 - Completed tenders received

End of September 2002 - Order

system

December 2002 - Data input begins

End February 2003 - Trial the system

Start of April 2003 - Fully operational

The

basis of the system is to provide the list of assets, site and floor plans,

programme maintenance, condition survey, asset valuation, running costs, and

title information. The system will be

user friendly and driven by a Geographical Information System.

Whilst

responsibility for the system is with the Head of Property Services the

development of this system has been delegated to the CPO, Building Manager and

the Property Statistics Officer, as an ICT Development Board.

3.3 Other ICT

All staff have links to the in-house

Intranet, Internet and e-mail facilities.

The commitment accounting system enables surveyors and stakeholders to

monitor both programmed and reactive maintenance expenditure for each service

and assess ongoing budget commitment against actual budget. A simple skills audit was carried out in

house in April 2002 and is being continually reviewed.

|

The new

system will provide quality information, which can be shared with clients

easily through Intranet facilities in order to improve service. This will enable proper monitoring of

performance through data being readily available.

The amount and quality of data held for Assets is

subject to on-going review in order to ensure clients are fully informed on

the performance of the assets they use.

Programmed

maintenance consultation with clients is based upon existing data and these

processes are being developed further.

Further

local performance indicators will be developed including the cost of each

hour open for each asset for example libraries, swimming pools, fire stations

and offices.

|

4.1 Performance

Measurement – Local and National Performance Indicators

Measurement of performance is at two levels. At a high level are the national pPIs as

defined by DTLR and national benchmarking exercises. Whilst locally, are the headline indicators in the BVPP and the

Local Performance Indicators agreed with Service Managers and the AMG. The Council has also invited Portsmouth City

Council to be its “Peer Group” for Asset Management.

Current performance measurements have

been reported to Members, Directors, AMG and benchmarking partners. The performance of Property Services has

been tested through a Best Value review.

The Council agrees the performance management is a key tool to auditing,

reviewing and improving asset utilisation which aims to:

|

·

Ensure service plan objectives

·

Promote continuous improvement

·

Facilitate bench marking and comparison

|

4.2 National Performance Indicators

The

Council has been a founder member in COPROP working with CIPFA to establish a

number of national benchmarking initiatives.

These exercises have included the performance of office buildings,

secondary schools and primary schools.

The

Council will continue its participation in these studies and looks forward to

benchmarking more operational service assets.

Results from this exercise are shared with stakeholders and have been

found particularly helpful for energy monitoring and utilisation, eg the

surplus capacity in one office has now been put to use by relocating storage.

The Council will continue to produce an annual Building

Programme Review which is submitted to members and managers and shows the

performance of the capital programme.

This report scores individual project performance in terms of budget and

estimates. These are shown as PPI 5A

and 5B in Appendix 8.

In support of the countrywide drive toward sustainable

energy and Agenda 21, the Council will continue to compare and measure CO2

emissions for all assets.

The Council welcomes the availability of two years’ national

performance indicators. Our analysis

shows: a reduction in management costs; reduced running costs and continued

improvement for the capital building programme. Further the Council is hopeful that national benchmarks are

to be established and maintained; this

would very much help the Island.

|

Performance results are reported to members through the

AMP that encourages a process of continuous improvement.

The Building Manager reviews targets such as the CO2

emissions and programmed maintenance annually and has set targets for

improvement.

The CPO

has used Benchmark data to inform target setting in offices and schools in

March 2002. The AMP will extend this

work to all service asset groups.

|

At a

local level the PI in the BVPP measures year on year change over the total

operation costs of assets as a percentage of total revenue. This puts a financial measurement to

utilisation (see box below). The CPO

annually reviews the Best Value Performance Plan and Council core objectives to

assess property implications.

For

each individual service area local performance indicators have been set that

divide between quantitative measurements and qualitative measurements. Examples of quantitative measures include:

cost per pupil, cost per fire tender, cost per book, cost per visitor, cost per

square metre (see cross reference to data management). For qualitative measurement this is an

independent survey of stakeholder/building occupiers by questionnaire aimed at

service returns as to satisfaction.

That is, in terms of suitability, sufficiency and on-going condition for

every property. This also raises

awareness of cross cutting issues such as accessibility to buildings, staff

facilities and shared facilities. These

indicators are considered to be very important and provide excellent data to

fully assess assets. Further Indicators

will be developed.

|

Performance

Indicator

(including

reference number where applicable)

|

Targets Against Indicator(s)

|

Current Performance Standard

|

|

Total operating costs (TOC) of property against

total revenue budget

|

Reduction of 0.5%, ie

£36,745

|

6% (£7,349k)

|

|

Operational property cost per square metre for

operational buildings (National pPI-4A)

|

Reduction 2%, ie £17.34

|

£17.69 per square metre

|

|

CO2 emissions – Government

target to reduce CO2 by 20% below 1990 levels

by 2010 (pPI-4B)

|

Reduction for 2002-2003 to

7,602 tonnes

|

CO2

emissions 7,679 tonnes

|

|

Cost of Corporate Services hourly rates

|

Per Technician/ Surveyor/ Principle/Manager

|

Internal average £25

External average £58

|

|

Cost of managing operational property per square

metre (pPI-3A)

|

Reduction by 2% to £3.12

|

£3.18

|

|

Cost of managing non-operational property per

square metre (pPI-3B)

|

Reduction by 2% to £2.61

|

£2.66

|

|

Percentage of authority buildings open to the

public in which all public areas are suitable for and accessible to disabled

persons (BVPI-156)

|

58% by March 2003

|

53%

|

|

Capital receipts target

|

Project target £1,500,000

|

£900,000

|

|

Improvement of cost and

time predictability in delivering new capital building projects (National

pPI-5A and 5B)

|

Improve cost of time

predictability by 1% to 91% and 67% respectively.

|

90% of

projects are under budget 66% of projects are completed on time

|

4.4 Non-Operational

Return

Non-operational

property is classified in the following three groups:

(a)

Land pending development

(b)

The disposal programme

(c)

Starter factory units for economic development

All

land pending development is made secure.

Each property within the disposal

programme has a target date ie between current year and three years plus for

disposal. (See 6.1 below).

Starter

factory units built in partnership with Government Agencies are retained under

Economic Policy for business promotion, the key performance indicator agreed is

occupancy percentage.

The

Council has no investment properties or retail units, has sold all its farms

and the majority of starter units have been jointly funded through English

Partnership.

4.5 Desk Occupation Survey

·

Property Services carried out a desk occupation survey

in January 2002 which showed an average office occupation of approximately 62%.

·

Range between 38% and 89%.

4.6 Suitability Questionnaire

In order to assess the

suitability a questionnaire will be circulated to building users in December

2002 and the results will be brought into the next AMP review.

Suitability Surveys have already

been completed for all schools by the Education Department in line with DfES

guidelines.

4.7 Maintenance Backlog

See

5.8 Property Maintenance for details of annual report.

The implementation of the AMP will be funded

through the capital programme and revenue expenditure. This section describes how the capital

programme will be developed and how it will relate to the requirements of the

AMP.

All capital projects funded from

"corporate" resources (those which can be spent entirely at the

Council's discretion) have been based upon priorities in the Council's capital

strategy. This has led to the

development of three year capital programme, which is rolled forward each year

The capital strategy defines how the Council will

determine what capital resources it has over the next 3 year period. Capital Receipts targets are based on the

availability of surplus assets from the non-operational portfolio as identified

in the AMP and agreed between the Director of Finance, the CPO and the

Executive.

The following are the Council's 3 year priorities

for capital spending using “corporate" resources:

Schemes which deliver priorities to be

identified in the Community Strategy will be a priority for corporate

resources.

|

Example

:

The

reduction in CO2 emission as a result of energy saving schemes at

Somerton School.

|

Schemes which

support the Council's Corporate Plan, namely ICT Strategy, Budget Strategy,

Personnel Strategy, AMP and Capital Strategy, are a corporate capital

priority.

|

Example :

Capital spending to generate revenue efficiencies.

Capital spending

to rationalise and maximise the efficient use of operational buildings. Investment in ICT infrastructure.

|

Schemes that

support Best Value. Capital projects,

which facilitate improvements in services that help demonstrate best value, are

a corporate priority. For example:

|

Example :

Expenditure to facilitate changes in the method of service

delivery

Investment to improve service delivery

Identification of capital disposal opportunities.

|

Each year the

Council will review its Capital Strategy.

Part of this review will be to assess the continued appropriateness of

the Council's capital priorities to ensure that priorities remain valid and

take account of new issues. For

example, the outcome of: Best Value reviews; Audits and Inspections; Housing

Investment Plan and Local Transport Plan.

The Capital Strategy details the methodology for

the option appraisal and prioritisation of projects over the three year capital

programme including a forecast of capital receipts. The diagram below illustrates the process. The Capital Strategy Group is responsible

for developing and monitoring the Capital Programme throughout the year.

Officers consult Members

during the formation of the Capital Programme on a service by service

basis. A Capital Programme Manual is

currently in draft format and will be submitted to Strategic Directors in

October 2002. The intended date of

implementation for the Manual is 1 January 2003. The purpose of the Manual is to modernise the current

process. Both the existing programme

and manual have the CFO as the lead officer.

A Lead Officer is responsible

for each capital project in terms of being accountable for physical and

financial progress and Members are informed on the performance and

implementation of the Capital Programme.

The

following table shows service changes in terms of asset management over the

next three years and have been agreed with Service Heads.

|

SERVICE

|

DO WE KNOW REQUIREMENTS?

|

ARE WE CHALLENGING?

|

AMP CHANGES

|

|

Social Services

|

|

|

|

|

Day Centres

|

P

|

P

|

Further partnering with

Health. Some surplus land to be sold.

|

|

Respite Care Homes

|

P

|

P

|

Managed buildings requiring

refurbishment. Replacement facility

to be planned.

|

|

Elderly Person Home

|

P

|

P

|

Privatised – Island Care 97

Ltd.

|

|

Neighbourhood Offices

|

P

|

P

|

Reviewing options, working

arrangements and teams. For Social

Services Service Plan see : http://wightnet2000.iow.gov.uk/

docs/polfs/socs_serviceplan/

n2002.pdf

|

|

Public Conveniences

|

X

|

P

|

Task Group working on

consolidation.

|

|

Schools

|

P

|

P

|

Challenging 3 tier/2 tier

provision. Changing funding of LSC.

Governors considering dual community use, eg sports halls and share

with libraries/ICT suites/homework space

|

|

Youth Centres

|

X

|

P

|

Forthcoming Best Value

Review.

|

|

TIC’s

|

P

|

P

|

Further co-locating

opportunities being explored

|

|

Fire Stations

|

P

|

P

|

Planning and bidding replacement

stations, Ventnor. BV Review and HMI completed. Possible new fire station and HQ at Newport.

|

|

Museums

|

P

|

P

|

Increased use of Guildhall

for new painting collection.

Relocation of Museums Workshop team.

|

|

Housing

|

P

|

P

|

No Council owned houses –

HRA closed. Current debate of Housing Associations being allowed 20% of sites

at 50% of site value or should it be higher?

From UDP – Urban Capacity Study to establish amount of ‘brown field’

sites. Target of 8,000 new units by 2011 - insufficient ‘brown field’ sites

therefore use of ‘green field’ sites defended. Too much B&B based accommodation – more affordable housing

required. For Housing Strategy

see : http://www.iow.gov.uk/

living_here/housing/house_strategy/

images/HOUSING STRATEGY

2002-2006.pdf.

|

|

Leisure

|

P

|

P

|

BVR recommends transfer of

leisure assets to a Not For Profit Trust.

Offices to be consolidated. Operational costs to be reviewed.

|

|

Cemeteries

|

P

|

P

|

Sell surplus assets and

identify use for redundant chapels.

|

|

Libraries

|

P

|

P

|

Replacement Library

HQ. Increased sharing opportunities.

|

|

|

|

|

|

5.4 Office Administration

Accommodation – Phase 3 Review

Members have

also agreed the Council’s Office Accommodation Phase 3 Review which provides a

10 year plan. The objectives of the

review are:

Rationalisation of space

Improved access to services

supported by e-government

The improved use of County Hall

as a central hub

Reduced property running and

maintenance costs through rationalisation

Improved staff facilities and

workstations

Reduce transport costs and congestion

The review

shows the main issues and accommodation moves which will improve services and

reduce costs. Utilisation is a key

issue and objectives of the plan include the rationalisation of space, improved

access to services supported by e-government, reduced property running and

maintenance costs, improved staff facilities and workstations and to reduce

transport costs and congestion.

Criteria for who should be located at the “hub” and services will be

assessed against it. The basis of the

Review complied with Council objectives and strategy through the Corporate

Plan.

The timeframe

for the implementation of the accommodation review is as follows:

The

Council has in place a Flexible Working Policy and has just approved the ICT

Strategy including resourcing “dial-up” infrastructure for remote working. Along with other members of COPROP the

Authority has joined the research project commissioned from Sheffield Hallam

University considering “Hot Desking” the details of which are being considered

in the Council's own flexible working agenda.

The Council

are currently investigating a number of significant areas for change. Through the Council's membership of CORROP,

Professor I F Price has been retained to report on Flexible Working Policies

and Environments in UK Local Authorities.

His findings have been examined and used where appropriate. A desk occupation survey has recently been

completed and its forming the basis of a Flexible Working Group which

has been set up and includes officers from ICT, Personnel, Property Services,

Social Services and Customer Relations.

The purpose of the Group is to improve the efficiency and delivery of

services through raising awareness of flexible working.

|

The AMP will encourage managers to embrace new space

reduction initiatives. Successful

schemes that reduce running costs will enable reinvestment of resources in

service delivery.

|

5.5 Constructionline

The Head of Property Services

together with the Head of Engineering Services in consultation with the Audit

Team has reviewed the Constructionline option. A report went to the Council’s Executive on 16 July 2002

recommending implementation and was approved by the Council.

5.6 Partnering

With a

view to developing collaborative working with the private sector in terms of

the procurement of building and engineering services the Council has brought in

Dr Neil Jarret of Warwick Business School to lead on this process, which

is to be rolled out corporately during 2002/2003 with pilot studies in two capital

projects.

5.7 Gap Analysis

The CPO reviews each Service Plan in mid-May. From the current round of service

planning gaps have been identified and

options considered. An example would be

relocation of Museum Workshop Team to an integrated facility.

As a result of the feedback from

the Service Plans a five year Strategic Plan will be created in mid-2003 for

action based on analysis between what is currently provided and what is

actually required.

Stakeholder requirements are

also established from Service Level Agreements, the AMG, Project Liaison Group,

Select Committee, agreeing individual AMP’s with Service heads, Condition

Surveys, programmed maintenance, Best Value Review, Risk Management and

individual users.

|

Example :

Enlarged server farm as a result of Risk Management

assessment. 69% of maintenance

programmed against 35% three years ago.

|